Energy entrepreneurs generating £350m worth of power a year

Energy entrepreneurs across Scotland invested £82m in 117 renewable energy projects last year, a new report reveals.

The spending by businesses, developers, farmers, landowners and communities means almost £700m has now been invested in the sector in Scotland in total, according to the sixth annual Energy Entrepreneurs Report produced by SmartestEnergy and being launched at the All-Energy renewables industry event in Glasgow this week.

The 1,213 independent renewable projects – those outside of the traditional energy supply sector – in Scotland have a total capacity of just under 3 gigawatts (GW). Together they generate electricity worth around £350m and are able to power more than 2.1m homes.

The latest figures show that in 2017 businesses in Scotland developed 22 new onsite generation projects, such as wind turbines to provide power for manufacturing sites and solar panels on warehouses. In total there are 83 onsite generation projects in operation.

Scottish farmers are behind 237 commercial-scale renewables projects and landowners, including a number of estates, account for 172 projects. The number of commercial-scale community-owned projects, which generate funds to be invested in local amenities, now stands at 65. Specialist developers are behind the majority of schemes in Scotland, owning 552 projects at the end of 2017.

Scotland saw the highest percentage growth in overall independent renewable project numbers across Great Britain, with a rise of 10.7%. Its 21.7% share of total GB independent renewable generation capacity means it continues to punch significantly above its weight given its relative population size.

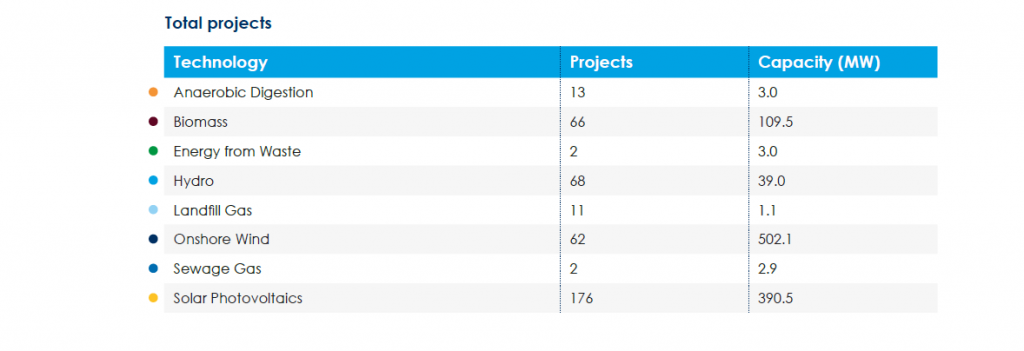

Onshore wind (84.3% of total capacity) remains by far the most significant technology in Scotland but hydro had a strong year, with 51 of the 68 new schemes located north of the border.

More than £227m invested GB-wide

Across Great Britain, the report shows more than £227m was invested in 400 new independent renewable energy projects in 2017.

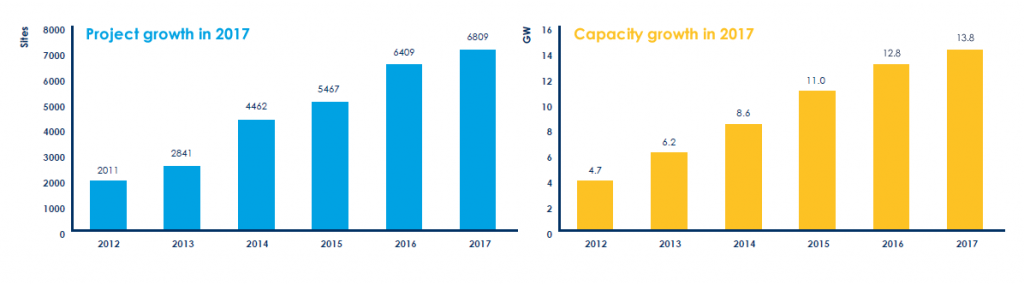

However, as renewable subsidies continue to fall away the pace of growth in the sector was the lowest seen since the report was launched in 2012.

With the Renewable Obligation Scheme closing to new projects last year and the Feed-in Tariff scheme due to close next March, the report highlights how energy entrepreneurs are now actively exploring new ways to make investments financially viable as they look ahead to a subsidy-free future.

Iain Robertson, Glasgow-based Vice President Renewables at SmartestEnergy, says:

“The reduction in subsidies has inevitably slowed growth in the independent generation sector but these latest figures underline the significant role energy entrepreneurs continue to play as the UK shifts to a decentralised, decarbonised and digitised energy system.”

Investment continues but growth slows

Although growth has slowed, SmartestEnergy’s Energy Entrepreneurs Report underlines the significant contribution the independent sector is making in meeting the nation’s energy needs.

More than 8.4 million households can now be powered by renewable energy projects outside of the traditional energy supply sector. In total they make up 9.2% of the GB energy mix – double their contribution just five years ago – and are helping the nation set new records for the longest periods without coal generation for more than 130 years.

The 400 new projects commissioned during the year represent a rise of 6.2% on total project numbers at the end of 2016. Capacity saw a greater increase, with an additional 1GW (8.2%) rise taking total capacity up to 13.8GW. The 31TWh of electricity generated was worth just under £1.4bn.

Almost £3bn has now been invested in 6,809 projects by the independent sector. However, the £227m spent during 2017 was almost 20% lower than the £280m seen in the previous year and down from the peak of £418m seen in 2014.

Moving towards a subsidy-free landscape

Robertson says “the financial environment for developing new projects has changed dramatically since the Energy Entrepreneurs Report began tracking the sector.”

Renewable energy projects capable of operating subsidy-free will be the exception rather than the norm for some time to come – particularly for less mature technologies – but it is seen as the long-term direction of travel for the sector.

“As we enter an era where generators will increasingly be expected to ‘stand on their own two feet’ and operate without subsidies, they will need to become active participants in the new energy system to develop revenue streams,” he adds.

Corporate PPAs provide a win-win

The report highlights routes to financial viability being explored including Corporate Power Purchase Agreements (PPAs) between generators and large energy users which provide generators with long-term revenue to secure finance.

The concept of Corporate PPAs has existed for years but the removal of subsidy support for renewables is expected to see the number of agreements accelerate. These agreements are attractive to large energy consumers as they can provide long-term price certainty for part of their energy supply. They could also support the company’s sustainability ambitions, demonstrating additionality by enabling a project that might not otherwise get built.

Our estimates show that 1.6TWh were consumed through corporate PPA’s last year, with the retail and banking sectors being among the most active, accounting for more than half of capacity. BT, Nationwide and Sainsbury’s are among the UK companies to have Corporate PPAs in place for some of their energy needs.

Extending the concept of co-location with battery storage

There is also a growing focus on the opportunities from co-location of storage with renewable generation and generators are considering new ways to structure commercial agreements to tap into new revenues.

While recent discussion on the topic of co-location has focused on adding battery storage to wind or solar projects, it could also include building multiple generation assets on the same site to share infrastructure. Innovative developments are showcasing the different options available, such as the Levenmouth Community Energy Project in Scotland which features a wind turbine and solar PV connected to a hydrogen storage facility.

“Demand for renewable energy continues to grow and there will be huge potential for those independent generators able to successfully navigate the new landscape ahead,” Robertson concludes.

Ends

NOTES TO EDITORS

For more information and to arrange interviews, please contact:

Emma Smeaton, Marketing Executive 07860 945865

Mike Shirley, Head of Marketing 07714 107940

About SmartestEnergy

SmartestEnergy is a next generation energy company, helping smart UK businesses navigate the energy revolution.

- One of the leading purchasers of electricity from independent renewable generators, buying directly from around 600 projects across the UK

- Licensed electricity supplier since 2008, we now supply electricity to over 2,000 businesses and were the first company in the UK to offer Carbon Trust Certified 100% renewable electricity

- As a supplier-aggregator since 2015, we help generators and consumers unlock value from flexible energy assets such as battery storage and Demand Side Response.

SmartestEnergy was established in 2001 and is wholly owned by Marubeni Corporation of Japan. It has a turnover in excess £400m and assets of over £300m, employing over 270 staff in three offices across London, Ipswich and Glasgow.

Additional information:

Key highlights from the 2018 Energy Entrepreneurs Report

- 6,809 projects now operating (+6.2% on 2016)

- Total generation reaches 13.8GW capacity (+8.2%)

- Total investment in independent renewables now stands at £2.97bn, up £227m in 2017 (+8.3%)

- 31TWh of electricity generated at a wholesale value of £1.38bn (+8.3%)

- Enough to power 8.38m households (+8.3%)

- Fastest rate of capacity growth seen in biomass (+21.6%) and hydro (+19%) projects

- Solar PV now accounts for more than 43% of all independent generation capacity compared to just under 7% in 2012.

New projects split by technology across GB